What Research About Can Teach You

Constant worry, depression, anxiety, and unremitting pains can make your life uninteresting and dull. It can go to an extent of making you refrain from that top paying career, abandon your dear ones, and having suicidal feelings. Providentially, the application of CBD oil and linked products can assist you in managing constant worry, depression, and apprehension hence making your life interesting. As a result, using your cash in purchasing CBD products can aid your life significantly than you can see in your mind’s eye. In essence, obtaining of CBD online is the safest technique to buying the most exceptional product according to this organization. Therefore, if you’re interested in obtaining CBD online, but you’re not positive on the safest way to do so, this article will help. On the whole, this company is here to help you out with leading tip on how to pay money for CBD products safely online so that you can get a hold fitting access to great products beforehand.

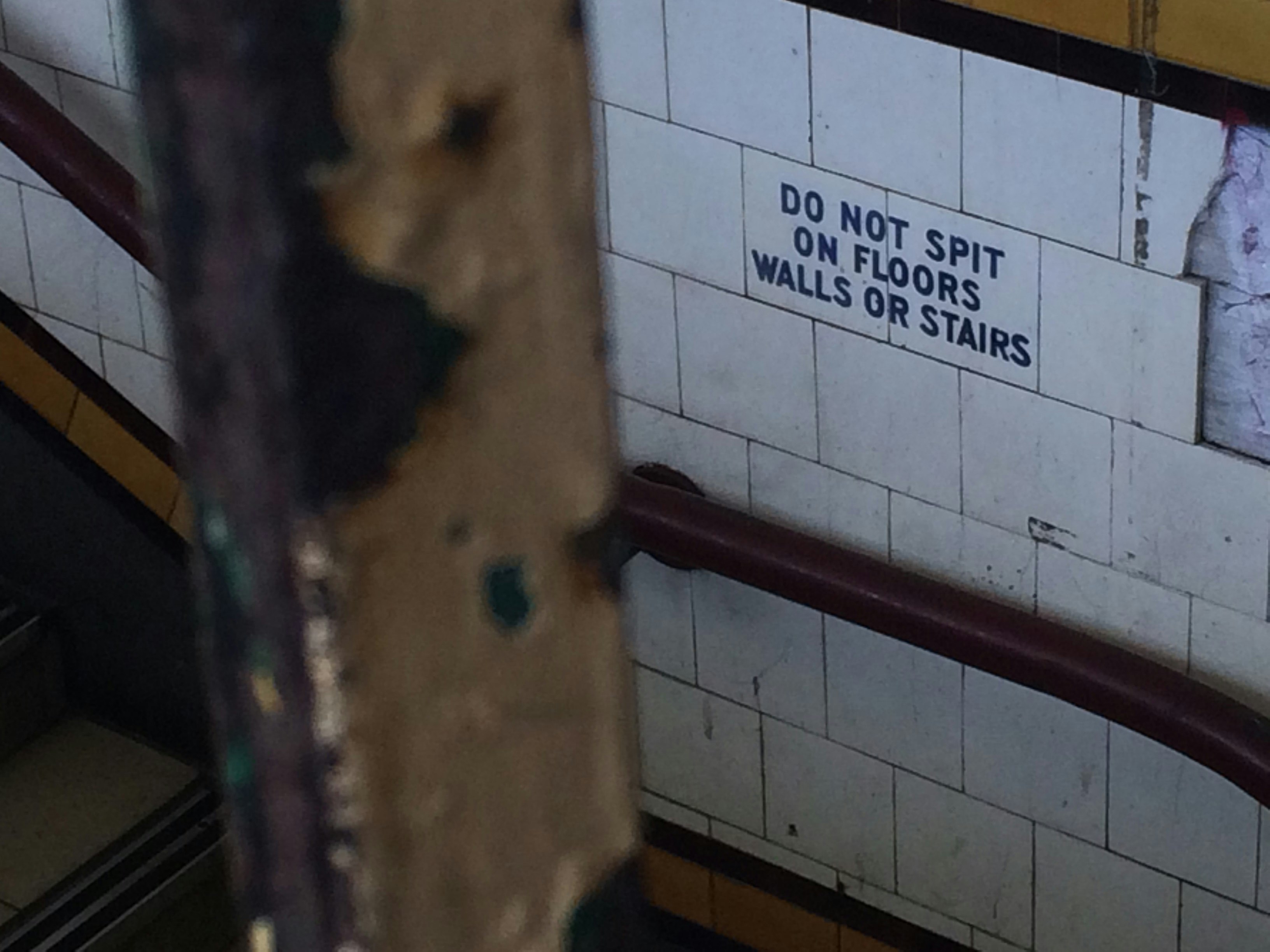

1 Picture Gallery: What Research About Can Teach You

Keep reading for a number of breathtaking tips and tricks that can assist you to sort through all the diverse CDB products online so that you can hit upon the most brilliant choice for you. First and foremost, before paying any amount of money, make sure to confirm the product ingredients. It means that when searching for CBD products to buy online, make sure you pay cross attention to the elements in the product as pointed out by these firms. This will help you out make out what category of benefits and side effects each ingredient might hold. The information made available on this website advocate that premium ingredients that are natural and organic are best. You will want to test out what brand of CBD is employed in each product too. The difference connecting different forms of these products come down to the extraction course of action, for instance, CBD isolate usually holds over ninety-five percent CBD, making it a pure choice.

Full-spectrum CBD product will have other available cannabinoids and THC integrated, such as this CBD commodity. According to the information made available by this website, there are numerous ways of taking out CBD from hemp plants, however, the CO2 process is the customary and safest alternative of them all as it is kept away from contagion. You’re supposed to also check to see how much CBD is in every prescribed amount of a product. It will facilitate in figuring out how many prescribed amounts come in every product which can assist you to settle on that you’re spending your cash intelligently. You would like to ensure that the dosage is in line with your body and detailed requirements as well according to the info offered in this site. Lastly, remember the pricing and product reviews.

This post topic: Health & Fitness